LACERA seeks to responsibly steward its investments in a manner that promotes and safeguards the economic interests of LACERA and its members, consistent with our mission. We do so by supporting policies and practices at the companies in which we invest, as well as public policies governing financial markets, that are consistent with LACERA’s economic interests to promote sustainable, long-term value.

Our guiding philosophy and proxy voting/active ownership responsibilities are outlined below. More details about LACERA’s philosophy and approach on corporate governance are provided in our Corporate Governance and Stewardship Principles.

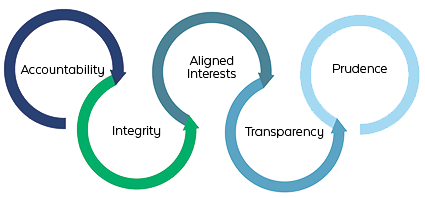

Guiding Philosophy

Five core concepts collectively provide the framework by which LACERA aims to promote sustainable investment returns and responsible stewardship of fund assets.

Accountability

Governance structures and practices should encourage the corporate boards of portfolio companies in which LACERA invests—as well as LACERA’s external asset managers—to be accountable to those who provide the firm with capital. Accountability helps to ensure that a firm is managed in the best interests of investors.

Integrity

Integrity and trust are the cornerstone of financial markets and essential for economic stability. Core investor rights and protections are crucial to promoting integrity in financial markets.

Aligned Interests

Executive compensation and incentives at portfolio companies and asset management fees should align the interests of senior executives and asset managers with those who provide the firm with capital—its investors.

Transparency

Investors should receive clear, comprehensive, and timely disclosures about fundamental elements of the business and financial activities of the firms in which they invest.

Prudence

Firms should prudently identify, assess, and manage environmental and social factors that may impact the firm’s ability to generate sustainable economic value.

Proxy Voting and Active Ownership

LACERA prudently exercises its rights as an investor to promote portfolio company practices and financial market policies that are consistent with LACERA’s philosophy on sound governance, as detailed in its Corporate Governance Principles.

Vote

LACERA diligently votes corporate proxies at the annual meetings of portfolio companies in adherence to its Corporate Governance Principles to encourage sound governance and prudent risk management. An overview of LACERA’s proxy voting results can be found here.

Engage

LACERA engages portfolio companies in dialogues as an investor to advance best practices on select priorities.

Advocate

LACERA promotes and safeguards its interests as an investor with legislators and regulators to advocate sound financial market policies.

Collaborate

LACERA collaborates with other pension fund systems and institutional investors to advance its common interests in prudent corporate governance and sound financial market policies.

LACERA is a signatory to the United Nations-affiliated Principles for Responsible Investment and a member of the following corporate governance associations:

- Council of Institutional Investors

- International Corporate Governance Network

- Asian Corporate Governance Association

![]()

![]()

![]()